Citi cited slower-than-expected EV penetration in India's two-wheeler segment, citing that GST cuts on internal combustion engine vehicles have narrowed the price gap and slowed electrification.

By Meghna Sen February 17, 2026, 9:34:02 AM IST (Published)

2 Min Read

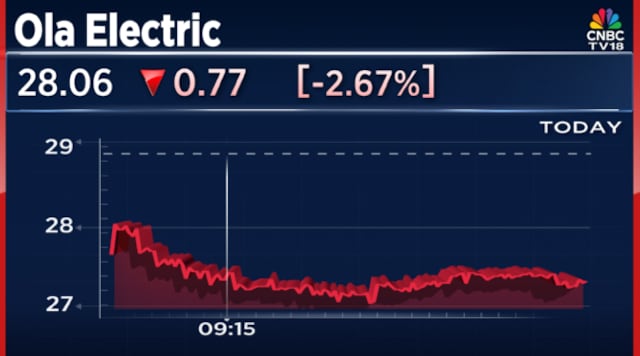

Shares of Ola Electric Mobility opened as much as 3% lower on Tuesday, February 17, extending losses to a fourth straight session. The stock has advanced in only one of the last six trading days.

Ola Electric shares are currently hovering near their 52-week low, and are down 20% over the past two months.

Trading activity has picked up sharply. Monday's volumes stood at 8.5 crore shares, well above the 10-day average of 3.86 crore.

Brokerage downgrades have added to the pressure. Citi has cut its rating on Ola Electric to 'Sell' from 'Buy' and slashed its price target by 51% to ₹27 from ₹55 earlier.

The brokerage cited slower-than-expected EV penetration in India's two-wheeler segment, citing that GST cuts on internal combustion engine vehicles have narrowed the price gap and slowed electrification.

Citi also flagged market share losses, driven by service-related challenges, intense competition and weak customer perception. The company's Q3 performance came in below estimates due to negative operating leverage.

While acknowledging improving gross margins and the potential for better operating leverage to lift EBITDA, Citi cautioned that management's efforts to enhance product and service quality may take time to yield results.

It also referred to concerns around cash flows, with 9MFY26 free cash flow at -₹1,530 crore. The brokerage estimates net debt at around ₹700 crore, with gross cash of about ₹2,000 crore post Q3.

Citi has sharply cut its estimates and reduced its target EV-to-sales multiple to 3.5x from 4.5x.

Of the eight analysts covering the stock, one has a 'Buy' rating, one recommends 'Hold', and six have a 'Sell'. Kotak Institutional Equities and Emkay Global have the lowest price targets on the Street at ₹20 apiece.

Following the recent slide, the stock has corrected 82% from its post-listing high of ₹157 and is down over 60% from its IPO price of ₹76.

Its market capitalisation has fallen to ₹12,430 crore, compared with over ₹65,000 crore at its peak.

Ola Electric shares were trading 2.53% lower at ₹28.09 and are down 25% so far in 2026.

Note To Readers

Disclaimer: The views and investment tips expressed by investment experts on CNBCTV18.com are their own and not that of the website or its management. CNBCTV18.com advises users to check with certified experts before taking any investment decisions.

2 hours ago

2 hours ago