The White House released a crypto roadmap to make America the global leader in digital assets, calling for legislative reform, banking access, stablecoin regulation, and tax and AML modernisation.

Representations of cryptocurrencies are seen in this illustration created on August 10. (Reuters Photo)

The White House unveiled sweeping recommendations from the President’s Working Group on Digital Asset Markets, outlining an ambitious strategy to solidify the United States’ leadership in blockchain and digital financial technology.

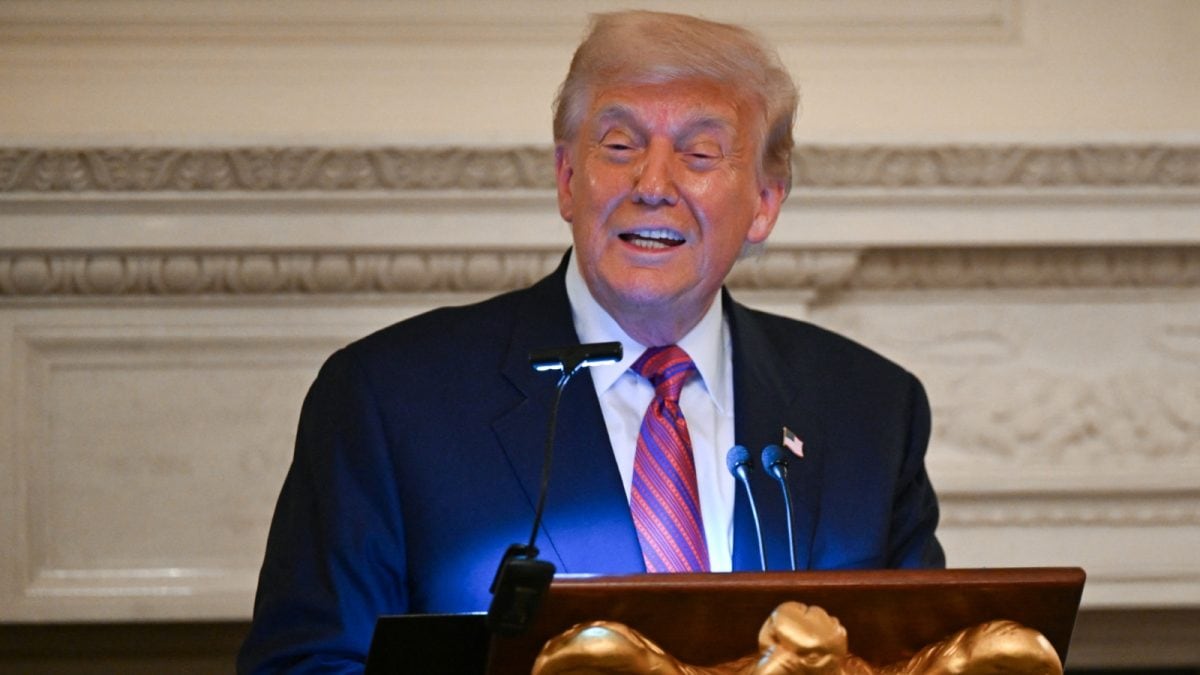

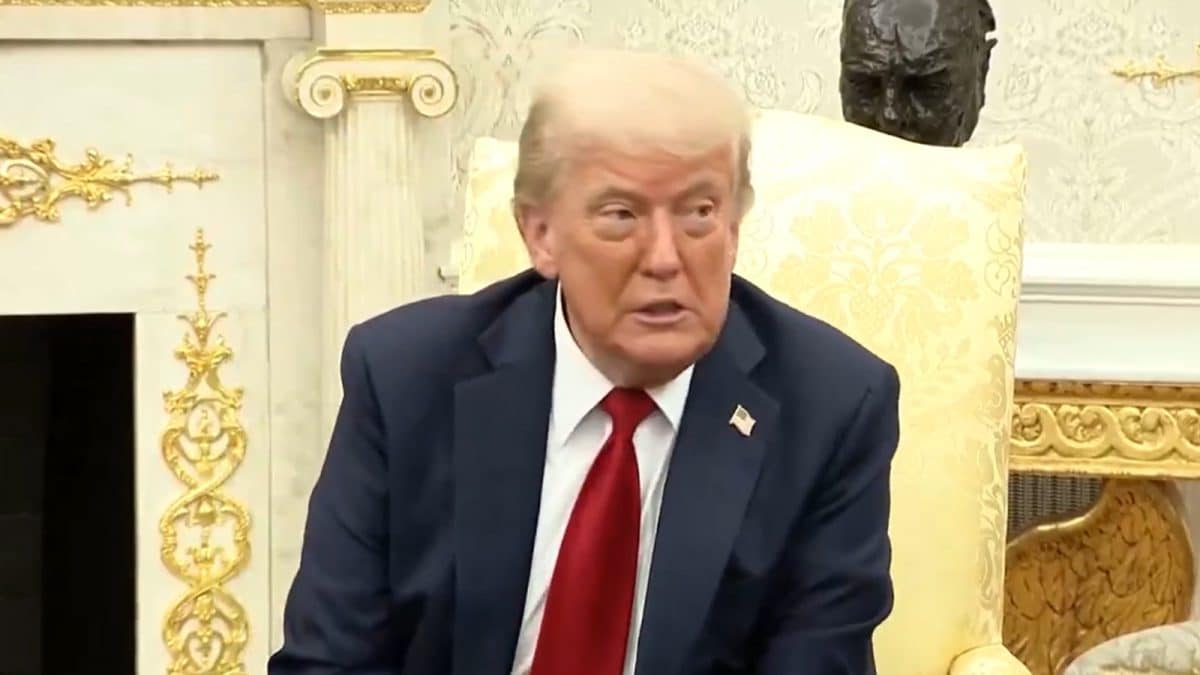

The report stems from Executive Order 14178, signed by President Trump earlier this year, which directed federal agencies to align policy, regulation, and innovation with his pledge to make America the “crypto capital of the world.”

“By implementing these recommendations, policymakers can ensure that the United States leads the blockchain revolution and ushers in the Golden Age of Crypto,” the Working Group said in its report.

The group — composed of officials across federal regulatory agencies — recommends a mix of legislative and executive actions, including clarity on regulatory oversight, expanded crypto banking access, a robust framework for stablecoins, and modernized tax and anti-money laundering laws.

KEY RECOMMENDATIONS:

1. Regulatory Clarity and Innovation

The Working Group calls on Congress to act on bipartisan momentum behind the CLARITY Act by granting the Commodity Futures Trading Commission (CFTC) the authority to oversee non-security digital asset spot markets. It also urges regulators to embrace DeFi and allow new financial products through tools like safe harbors and regulatory sandboxes.

“A fit-for-purpose market structure framework is essential to support growth and innovation,” the report states.

2. Crypto-Friendly Banking Reforms

After ending "Operation Choke Point 2.0," the Trump administration now wants clear banking rules for custody, stablecoin issuance, and blockchain use. The group stresses aligning capital requirements with real risks, not just the “fact of their presence on a distributed ledger.”

3. The GENIUS Act and Stablecoins

With the recent signing of the GENIUS Act, America has enacted its first federal stablecoin framework. The group calls for swift implementation and proposes the Anti-CBDC Surveillance State Act, which would codify Trump’s executive order banning Central Bank Digital Currencies.

“The widespread adoption of dollar-backed stablecoins will modernize payments infrastructure,” the report adds.

4. Combating Illicit Finance Without Overreach

The group seeks modern AML rules that protect national security without infringing on self-custody rights or targeting law-abiding citizens.

5. Digital Asset Tax Reforms

The IRS and Treasury are advised to reduce red tape, clarify rules around mining, staking, and de minimis receipts, and adjust tax codes to treat digital assets as a distinct asset class — subject to modified securities and commodity rules.

- Ends

Published By:

Aashish Vashistha

Published On:

Jul 31, 2025

21 hours ago

21 hours ago