The UK government has struck a deal worth more than £38bn with private investors to back Britain’s biggest nuclear project in a generation at the Sizewell C site on the Suffolk coast.

The long-awaited multibillion-pound deal, which will be paid for through taxes and energy bills, gives the final go-ahead for construction of the nuclear project which has almost doubled in cost from when it was first proposed.

It brings together investment from the UK government and Sizewell C’s developer, the French state-owned energy group EDF, with a consortium of three other investors including the British Gas parent company Centrica.

Sizewell C is expected to generate enough low-carbon electricity to power 6m UK homes when it begins operations in the mid to late 2030s, although an exact start date for the project has not been set by the government. The plant will create 10,000 jobs at the peak of its construction.

It is considered the successor project to the Hinkley Point C nuclear power plant in Somerset where costs have climbed from an estimated £18bn to begin generating power in 2017 to about £46bn with an expected start-up date in the early 2030s.

Households will begin footing the project’s construction costs from this winter at a rate of £1 a month for every billpayer until the project is complete.

The funding mechanism means that Sizewell’s investors will be shielded from the impact of any delays and overruns during construction even if the total cost spirals to as much as £47bn.

The UK government’s stake in the project stood at 84% at the end of last year compared with EDF’s 16% share of the project. Under the final deal, the government will remain the project’s largest shareholder, with a 44.9% stake, while the French utility’s share shrinks to 12.5%.

Centrica will take a 15% share of the project while the Canadian investment group La Caisse will hold 20%, and investment manager Amber Infrastructure will take an initial 7.6%.

The French government had lobbied UK ministers to share the burden of extra costs to build Sizewell C after its Chinese partner, CGN, was removed from the project over security fears.

The final agreement marks the end of a 15-year journey to secure investment for the nuclear plant since Sizewell C was first earmarked for new nuclear development in 2010.

It should deliver Britain’s second nuclear power plant in a generation after EDF’s Hinkley Point C.

However, the rising costs for both projects in recent years, due to cost overruns and delays, have raised questions over the government’s nuclear power ambitions.

skip past newsletter promotionafter newsletter promotion

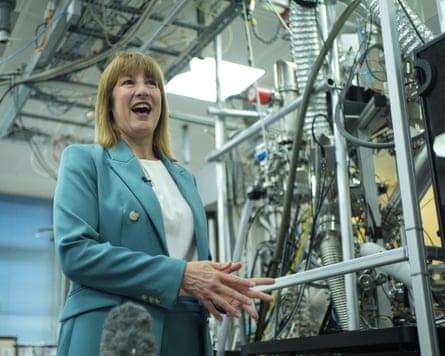

Rachel Reeves, the chancellor, said the multibillion-pound investment was “a powerful endorsement of the UK as the best place to do business and as a global hub for nuclear energy”.

“Delivering next-generation, publicly owned clean power is vital to our energy security and growth, which is why we backed Sizewell C. This investment will create thousands of good-quality jobs and boost the local economy as we deliver on our plan for change,” she said.

The financial framework designed to support the project has angered anti-nuclear campaigners because it will grant EDF support via energy bills from the start of its construction. This means households could be on the hook for construction delays and cost overruns at Sizewell C, according to campaigners.

The new framework differs from the model used to support the Hinkley Point C project, which will earn revenue for EDF only once the plant begins generating electricity in the early 2030s.

Chris O’Shea, the chief executive of Centrica, said he expected the company’s returns on the Sizewell C investment to reach almost 11%, and that the returns would be “acceptable” even if costs reached the £47bn mark. He added that he was confident that Sizewell would be quicker to build than Hinkley Point.

Once the power plant begins generating electricity the government expects it will save the electricity system £2bn a year relative to other low-carbon technologies.

The project has promised to generate electricity at a price of between £86-£100 a megawatt-hour (MWh) on average over the 60-year life of the project. As a comparison, the market reference price used to pay low-carbon energy subsidies last summer was just over £80 a MWh.

Contact us about this story

Show

The best public interest journalism relies on first-hand accounts from people in the know.

If you have something to share on this subject you can contact us confidentially using the following methods.

Secure Messaging in the Guardian app

The Guardian app has a tool to send tips about stories. Messages are end to end encrypted and concealed within the routine activity that every Guardian mobile app performs. This prevents an observer from knowing that you are communicating with us at all, let alone what is being said.

If you don't already have the Guardian app, download it (iOS/Android) and go to the menu. Select ‘Secure Messaging’.

SecureDrop, instant messengers, email, telephone and post

See our guide at theguardian.com/tips for alternative methods and the pros and cons of each.

Illustration: Guardian Design / Rich Cousins

1 month ago

1 month ago