HomeMarket NewsForeign investors cautious on India amid global rotation and gold rally: Manulife’s Marc Franklin

Marc Franklin, Deputy Head-Multi Asset Solutions-Asia at Manulife Investments, said investor interest in Indian equities could return quickly if global capital flows reverse or momentum in competing asset classes cools, supported by strong underlying fundamentals.

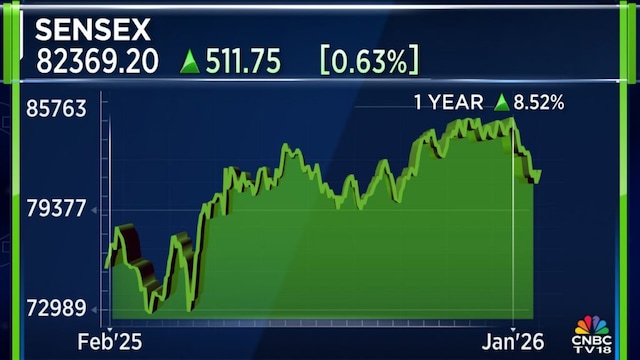

India’s recent equity market underperformance should not be mistaken for a weakening of its fundamentals, said Marc Franklin, Deputy Head-Multi Asset Solutions Asia at Manulife Investments, arguing that global capital is being redirected by opportunity cost rather than risk aversion.

Franklin said persistent outflows from Indian equities reflect investors chasing stronger cyclical stories elsewhere, particularly in markets such as Korea and Taiwan, which have benefited from a powerful semiconductor and memory chip upcycle.

At the same time, domestic investors in India have been reallocating capital towards precious metals amid a sharp rally in gold and silver, reducing flows into equities. “The fundamentals do seem quite well for us,” Franklin said, stressing that India’s macro and corporate backdrop remains intact even as sentiment and technical indicators stay weak.

From a portfolio perspective, Franklin said Manulife has maintained a cautious stance on India not because of heightened downside risks, but due to relative return considerations. He stated that a reversal in global flows or a cooling of momentum in competing asset classes could quickly restore investor interest in Indian equities, given the strength of underlying fundamentals.

Commenting on the newly announced India–European Union trade agreement, Franklin said the deal is unlikely to provoke a strong reaction from the US. With the Trump administration focused on multiple tariffs, industrial and geopolitical priorities, he described the agreement as a marginal easing of trade barriers rather than a trigger for a broader shift in global trade dynamics. “Other countries will seek comfort from more entrenched bilateral agreements,” he said, adding that the deal reflects a defensive hedge rather than a structural realignment.

Also Read: EU trade deal unlikely to hurt Indian autos; banks offer better play, says Quantum Advisors

On currencies, Franklin said a weaker US dollar aligns with the US administration’s longer-term objectives of reducing the current account deficit and encouraging domestic manufacturing through reshoring. However, he cautioned that the dollar has already moved sharply lower in a short period. “We are somewhat oversold in the US dollar,” he said, suggesting that while the medium-term direction may still point lower, near-term technical reversals are possible.

Looking ahead to US monetary policy, Franklin expects the Federal Reserve’s upcoming decisions to have a more muted impact on markets now that rate cuts priced by investors have been pushed into the second half of the year. With US labour markets moderating but not deteriorating sharply, and inflation broadly tracking expectations, he believes the Fed is likely to stick closely to its data-driven approach, barring any unexpected political signaling.

Also Read: China fund exodus hits record $40 billion in one week as investors rush to gold: EPFR

For the entire interview, watch the accompanying video

Catch all the latest updates from the stock market here

Also, catch the latest Budget 2026 expectations updates here

1 hour ago

1 hour ago