When Trump threatened Iran in early 2026, Saudi Arabia refused him access. No airspace, no bases, no loyalty. The armada sailed but the runways stayed closed. Beijing's 2023 deal had quietly rewritten the rules.

US President Donald Trump shaking hands with his Chinese counterpart Xi Jinping at the APEC Conference on October, 2025. (Image: File)

For a brief moment in early 2026, the world braced for another Middle East conflagration. Trump threatened strikes on Iran. US armadas set sail. Fighter jets relocated. The gun was loaded and ready to shoot. Then, suddenly, everything descaled. Not because Washington backed down, but because Riyadh said no.

Saudi Arabia denied airspace. It denied bases. It denied the automatic loyalty that had defined Gulf security architecture for decades. The refusal carried weight because a dtente existed between Riyadh and Tehran. And that dtente carried a Chinese signature.

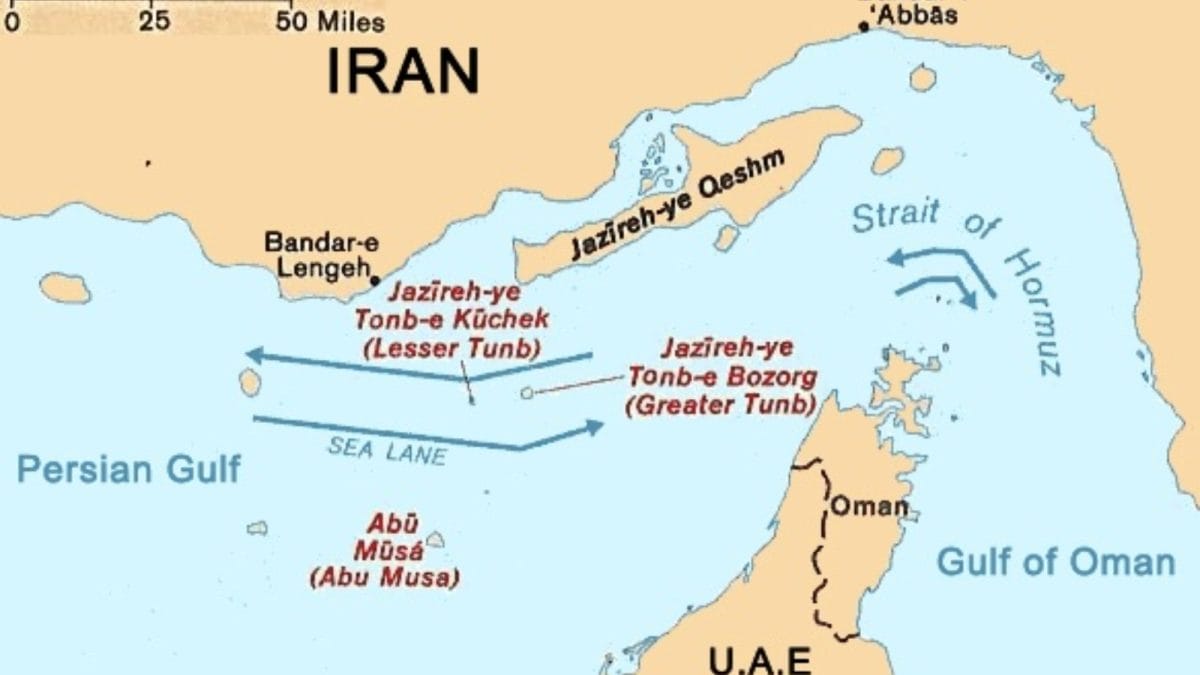

On 10 March 2023, Beijing hosted the final trilateral talks that restored diplomatic ties between Iran and Saudi Arabia after seven years of rupture. Iraq and Oman had handled earlier rounds, but China stamped the guarantee. The arithmetic was simple. Iran depended on Chinese buyers for 90 per cent of its oil exports. Saudi counted China as a key customer. Embassies reopened. Non-interference pledges surfaced. Yemen's temperature dropped.

Fast forward to 2026. That architecture held under fire. Trump had revived maximum pressure. Operation Midnight Hammer in June 2025 obliterated Iranian nuclear sites. An Israel-Iran war flared and ended on 24 June. Protests shook Iran in January 2026. An armada moved towards the Gulf. Tehran warned it would hit US bases across the region if strikes proceeded.

Prince Sultan Air Base sat within range. NAVCENT in Jubail sat within reach. Eskan Village stood exposed. Riyadh read the board. War meant retaliation. Retaliation meant oil shock. Oil shock meant Vision 2030 under siege. So Saudi Arabia refused access.

That refusal was disciplined, not dramatic. Riyadh urged neighbours against US strikes. It warned Iran against targeting Gulf bases. It refused airspace. It lobbied Washington. MBS called President Pezeshkian on 27 January and stressed diplomacy. The UAE, Oman and Qatar echoed caution. Washington shifted from strikes to sanctions. Oman-mediated talks resumed by February. Tension eased.

That sequence did not arise from slogans. It arose from managed rivalry forged in Beijing. China's leverage never hid. It imported roughly 1.4 million barrels per day of Iranian oil, delivering 30 to 40 billion dollars annually to Tehran despite sanctions. A 25-year comprehensive partnership pledged 400 billion dollars in investments across oil and infrastructure. BRI corridors ran through Iranian geography.

A US strike risked Hormuz disruption. Hormuz carried 20 per cent of global oil. Prices could spike beyond 150 dollars per barrel. China's economy would absorb the shock. So Beijing protected its artery. Stability served interest. Interest served mediation.

Proxy clashes in Yemen fell sharply after the 2023 deal. Working groups on security appeared. In July 2025, Araghchi met Prince Khalid bin Salman and discussed borders, Yemen, Palestine and de-escalation. In April 2025, Khalid visited Tehran and met Khamenei, conveying no support for strikes on Iran or Houthis. In January 2026, foreign ministers spoke again. On 10 February, Saudi leadership congratulated Iran's president on national day. Civility persisted amid stress.

Now contrast posture and performance. Trump unveiled a 20-point Gaza peace plan in September 2025 and a Board of Peace in January 2026. He hailed historic ceremonies and everlasting peace. Fine. But on Iran, Gulf states denied the battlefield. Saudi autonomy grew. Riyadh balanced alliance with engagement. Trump threatened. Riyadh calculated. Beijing's earlier deal supplied the buffer.

China's role stayed bounded. It did not enforce compliance. It did not veto US deployments. It urged restraint during the 2025 strikes and avoided direct intervention. But the core bargain held because interests aligned. Beijing secured oil and BRI corridors. Riyadh secured stability and Vision 2030 runway. Tehran secured economic oxygen and regional breathing space.

Motives matter. Beijing acted because a US attack on Iran threatened Chinese energy security. Forty per cent of China's oil imports tied to Gulf flows. Hormuz closure threatened that artery. War threatened 400 billion dollars in pledged projects. Altruism played a minor role. Self-interest drove urgency. But self-interest aligned with de-escalation. In geopolitics, alignment beats sermons.

This episode marked Gulf autonomy from automatic US policy alignment. Saudi Arabia refused access despite alliance ties. The Gulf chose self-preservation over spectacle. That autonomy emerged within a dtente architecture China helped design. It signalled a post-US security architecture under construction, one that balances arms deals with dialogue.

Trump boasted about deals. China locked in oil contracts and reopened embassies. Trump threatened obliteration deadlines. China convened trilaterals and pressed for non-interference. Trump deployed carriers. Saudi denied runways. De-escalation followed. Credit flows along the chain of causality. The 2023 Saudi-Iran deal formed the first link. China forged that link.

- Ends

Published By:

indiatodayglobal

Published On:

Feb 16, 2026

2 hours ago

2 hours ago