Introduction: Bank of England could cut rates faster if jobs market slows, governor says

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

The pound has dropped to a three-week low this morning, after the governor of the Bank of England said it could make larger cuts to interest rates if the jobs market slows quickly.

Andrew Bailey told The Times that “slack” was opening up in the UK economy, following the increase to employers’ national insurance contributions. That slack should create downward pressure on inflation.

Bailey insisted: “I really do believe the path is downward” for interest rates. Bank rate is currently 4.25%, following four quarter-point cuts in the last year, with the Bank next scheduled to set rates on 7 August,

Bailey added:

“If we saw the slack opening up much more quickly, that would lead us to a different conclusion.”

“I think the path [for interest rates] is down. I really do believe the path is downward but we continue to use the words ‘gradual and careful’ because … some people say to me, ‘Why are you cutting when inflation’s above target?’”

Governor Bailey also pointed to Rachel Reeves’s decision to hike taxes on employers, saying companies were:

“adjusting employment and hours and also having pay rises that are possibly less than they would have been if the NICs change hadn’t happened”.

Last week, the Guardian revealed that the Trust is to cut at least 550 jobs in efforts to save £26m after changes made in Reeves’s debut budget pushed up labour costs.

Hospitality firms have repeatedly warned that higher NICS will force them to cut jobs.

And indeed, new data this morning shows that the number of people hunting for jobs has surged at the fastest rate since the height of the Covid pandemic.

Following Bailey’s rate cut hint, the pound has dropped by 0.2% this morning to $1.3467.

That’s its lowest level since 23 June, three weeks ago, extending its recent losses.

Key events Show key events only Please turn on JavaScript to use this feature

Thames Water to introduce hosepipe ban in Swindon, Gloucestershire, Oxfordshire, Berkshire and Wiltshire

Water news: Households in several English counties have just been hit by a hosepipe ban.

Thames Water has announced that a hosepipe ban across Swindon, Gloucestershire, Oxfordshire, Berkshire and Wiltshire will kick in at one minute past midnight on Tuesday 22 July.

The ban will apply to all OX, GL, SN, RG4,RG8 and RG9 postcodes.

Thames explains that the current heatwave has hit water supplies to these areas, saying:

Water for much of this area is supplied by Farmoor Reservoir. Farmoor is fed by pumping water from the River Thames. The amount of water we can pump is dependent on the amount of flow in the river. We must leave enough flow remaining to protect the environment and maintain navigation.

The very dry and warm weather we’ve had means that the flow in the river is low. This therefore impacts the amount of water we can pump into Farmoor Reservoir.

Some homes in Oxford had an, umm, dry run of water disruption last week – some homes and businesses in the city were left with no water or low pressure due to a burst pipe (including my excellent local pub!).

MP’s will hear from Thames Water chairman Sir Adrian Montague, CEO Chris Weston, and non-executive director Ian Pearson tomorrow morning, to discuss the company’s financial problems.

Silver hits 14-year high

The spot price of silver has hit its highest level since 2011 this morning.

Silver traded as high as $39.09 per ounce, a 14-year high.

Rostro’s chief market analyst, Joshua Mahony, says the jump in silver is an example of “resurgent demand for non-fiat assets” (see also bitcoin), adding:

Notably, the rise in US debt coupled with higher stimulative spending does provide the basis for a more optimistic outlook for silver given its industrial use cases.

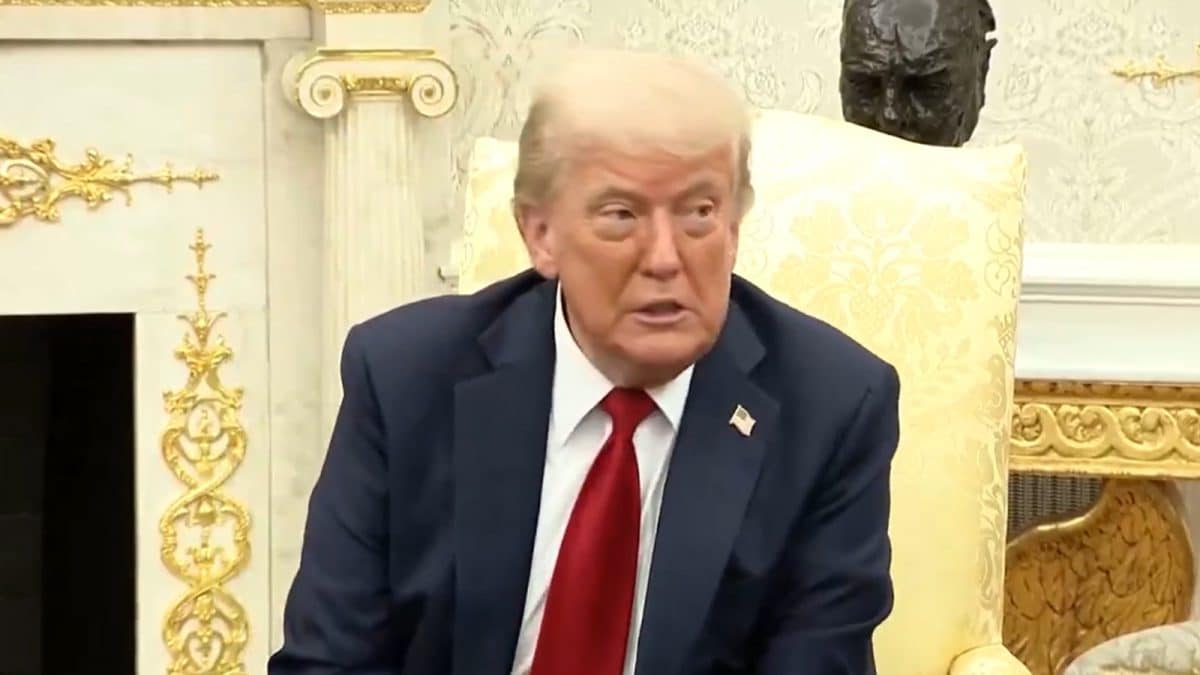

Another factor could be Donald Trump’s surprise 50% tariff on copper, which could spur higher demand for silver imports, just in case….

Bloomberg reports that increased demand is leading to tighter physical supply of silver.

Bundesbank: German exporters losing competitiveness

Germany’s exporters have grown less competitive in recent years, leading to a fall in thir market share, the country’s central bank is warning today.

The Bundesbank has calculated that more than three-quarters of the losses in export market shares between 2021 and 2023 were due to a deterioration in the competitiveness of German exporters.

In a new report into “the sustained decline in German export market shares”, the Bundesbank says:

The weak performance of German exports in recent years has been accompanied by significant market share losses for the German export industry.

German export market shares have been contracting since 2017 and have increasingly fallen behind those of other advanced economies since 2021. As a result, the losses in market share have contributed significantly to the sluggish growth of the German economy.

The Bundesbank has concluded that this decline is due to supply-side problems within Germany’s economy, which have affected some of its largest sector.

It says:

The machinery industry, electrical industry and energy-intensive sectors such as the chemical industry were the biggest contributors to the drop in competitiveness. The sectoral profile and timing of the losses in competitiveness suggest that supply chain problems and energy price increases weighed particularly heavily.

Bloomberg have spotted that options traders are turning against the pound.

One-month risk reversals — which show the difference in demand for bullish and bearish options — reflect the most negative outlook for the pound since February. The measure spans the next Bank of England and Federal Reserve decisions, as well as President Donald Trump’s 1 August tariff deadline.

UK to consider mutualisation of Post Office

Mark Sweney

UK government ministers are to consider handing ownership of the Post Office to post office operators in the wake of the Horizon IT scandal, my colleague Mark Sweney reports.

The Department for Business and Trade (DBT) has published a green paper starting the first major review of the scandal-plagued organisation in 15 years.

The review, which will run until the 6th of October, follows the publication last week of the first part of the two-year public inquiry into the Horizon IT scandal.

Ministers said that part of the review will include looking at ownership of the Post Office, which is ultimately controlled by the government, including the possibility of mutualisation.

Ministers have previously met with representatives of post office operators to discuss the possibility of handing ownership to the network branch managers who run its 11,500 outlets.

“This green paper marks the start of an honest conversation about what people want and need from their Post Office in the years ahead,” said Gareth Thomas, the post office minister, adding:

“Post Offices continue to be a central part of our high streets and communities across the country. However, after 15 years without a proper review, and in the aftermath of the Horizon scandal, it’s clear we need a fresh vision for the future.”

Wall Street futures are lower

Wall Street is set to open lower in a little over four hour’s time, following Europe’s lead.

The Dow Jones industrial average, the S&P 500 and the tech-focused Nasdaq are all down 0.3% in pre-market trading.

Joshua Mahony, chief market analyst at Rostro, says:

Donald Trump has once again done his best to dampen market sentiment, with mainland European stocks in the red and their US counterparts likely to follow suit.

This comes after Trump’s tariffs letters reached the EU (30%) and Mexico (30%), building on the 35% tax announced for Canadian imports last week. We now have less than three-weeks until the 1 August deadline comes into play, and the EU are already warning of a prospective 21 billion euros worth of goods that they would target in return.

Nonetheless, there is a clear desire to strike a deal, even if that means keeping the 10% tariff and seeking concessions on the sector specific taxes on the likes of the auto sector.

Donald Trump’s deadline of 1 August for trade deals, or new high tariffs, could create market turbulence this summer.

Henry Allen, economist and strategist at Deutsche Bank says investors should beware the end of this month….

Last year, the late-July/early August period set the stage for the worst market turmoil of 2024. This year, that week looks seriously problematic again from a market perspective.

First, there’s the new August 1 tariff deadline. Markets are clearly not pricing in these higher tariffs, and we may only know the outcome in the final hours, offering the potential for a sharp market reaction and heightened volatility.

Second, it’s the US jobs report that same day, and last year demonstrated that even a modest downside surprise can cause a big selloff, if investors are already jittery.

Third, long-end bond yields are going into this period at higher levels today, meaning it would take less of a jump before we move into problematic territory that re-ignites fears around fiscal policy.

This means the market narrative could suddenly shift in a more negative direction. If the tariffs snap back higher on August 1, and we then get an underwhelming jobs report, that would easily resurrect fears around a US recession.

Berenberg: Reasons for optimism, and pessimism, over US-EU trade deal

Despite Donald Trump’s tariff threats, Berenberg economist Salomon Fiedler believes the general US tariff rate on EU imports will end up “far below 30%”.

Fiedler says there are several reasons for optimism that a deal will be reached:

Trump has multiple times staked out extreme initial positions as a negotiation tool to be able to later “compromise” at a point still closer to his position. For example, on “Liberation Day” Trump initially announced a 20% tariff on the EU which he then rolled back to 10%. Since then, the EU seems to have accepted this 10% rate as the new baseline against which it will not retaliate. The fact that Trump only threatened the new 30% rate for 1 August, instead of implementing it more quickly, suggests he is still looking to negotiate.

Inflation is unpopular. Over the summer, firms will increasingly pass on higher import costs to US consumers as the inventories they built up in anticipation of Trump’s tariffs empty out. Rising inflation (and the prospect of Fed rate cuts becoming ever more remote) may give Trump second thoughts about adding yet even more tariffs.

Possibly, part of Trump’s motivation for the high tariff threat now was to shift the public debate in the US back towards more familiar ground (and away from, e.g., the Epstein files debacle).

But Fiedler adds there are several reasons for pessimism, which could lead to the Trump tariff on the EU ending up rather higher than 10%:

The tariffs alone will not fix the US’ trade deficits, which will thus remain a sore spot for the remainder of Trump’s term.

Trump is not only using tariffs as a trade policy tool but also as a source of revenues to plug at least part of the gaping hole in the federal budget. Recent comments from his administration suggest that they rely even more on tariff income than we previously assumed – and that they thus may be tempted to collect even more money by raising rates.

The always remote hope of a good negotiation outcome – the bilateral removal of all tariffs and some other trade barriers between the EU and the US – has all but disappeared from view by now

Markets raise expectations for UK interest rate cut in August

A Bank of England interest rate cut next month is looking more likely, according to the latest city pricing.

The money markets are indicating there’s now an 85% chance that the Bank cuts interest rates at its next meeting on 7 August, up from 76% at the end of last week.

This follows BoE governor Andrew Bailey’s suggestion that the Bank is ready to make larger cuts to interest rates if the jobs market shows signs of a pronounced slowdown (see opening post).

The City is expecting a quarter-point reduction, lowering Bank rate from 4.25% to 4%.

Victoria Scholar, head of investment at interactive investor, points out that the next UK inflation report, on Wednesday, will be crucial too:

Scholar writes:

Friday’s disappointing GDP figures, combined with these weak jobs figures boost the case for the Bank of England to cut interest rates in August. The central bank’s governor Andrew Bailey told The Times ‘slack’ was opening up in the labour market, and he believes ‘the path is downward’ for interest rates.

All eyes are on Wednesday’s inflation report with CPI expected to remain at remain around 3.4% in June, roughly unchanged for the third consecutive month.”

Britain’s major stock market index is shrugging off trade war jitters.

The FTSE 100 share index has risen by 15 points, or 0.18%, to 8956 points, towards the record highs set last week.

European markets open lower after Trump's tariff threat

Donald Trump’s threat to impose a 30% on European Union imports from next month is weighing on European stock markets this morning.

Most of Europe’s markets have dropped at the start of trading, pulling the pan-European Stoxx 600 index down by 0.6%.

Germany’s DAX has dropped by 0.95%, while France’s CAC 40 has lost 0.8%, Italy’s FTSE MIB index is almost 0.9% lower, and Spain’s IBEX is off 0.7%.

Investors will be assessing the chances of the two sides reaching a deal by 1 August, and noting EU trade commissioner Maroš Šefčovič’s suggestion that the two sides are approaching a good outcome (see 8.06am).

Richard Hunter, head of markets at interactive investor, says Trump’s tariff threats “show no signs of abating”, adding:

Inadvertently or otherwise the President is testing the market’s patience. At a time when investors had seemingly brushed aside the likelihood of the base line of tariffs settling at 10%, the new pronouncements suggest a level of between 15% and 20% being the norm, with additionally punitive numbers on the likes of Canada at 35% adding to the uncertainty.

The so-called “TACO” trade will therefore be tested again, with markets drifting in the US on Friday and futures currently suggesting a similar fall today. In addition, and as the new 1 August extension approaches, nerves are likely to jangle.

The pound is slipping lower against the dollar – it’s now down almost half a cent at $1.3457 (still a three-week low).

Jefferies’ Mohit Kumare says Bank of England governor Andrew Bailey “was on the dovish side” in his interview with The Times, “suggesting that the path of rates is downwards”.

EU and US approaching a good trade deal, claims trade commissioner

EU trade commissioner Maroš Šefčovič has claimed the European Union and United States are approaching a good outcome in their trade talks.

Despite Donald Trump announcing 30% tariffs on EU exports on Saturday, Šefčovič struck an upbeat tone this morning, saying:

“The feeling on our side was that we are very close to an agreement.”

Šefčovič also warned that the 30% tariff threatened by Trump would practically eliminate trade, Reuters reports. He was speaking before European trade ministers meet in Brussels to discuss the situation.

Some economists also believe that the US and EU will reach an agreement

Mohit Kumar of investment bank Jefferies says:

We see the 30% tariffs announcement as an opening move and eventual tariffs are likely to set lower in the 10-15% range. The announcement of higher tariffs is a negotiation tactic which should encourage EU and other countries to make a deal quickly.

However, the recent tariff announcements over last week also highlight the uncertainty around tariffs and that uncertainty has probably moved up a notch.

Trade data released this morning shows that China’s exports regained some momentum in June.

China’s exports rose 5.8% in June from a year earlier to $325bn, while imports rose 1.1% to grow, according to data from the General Administration of Customs.

Shipments to the US fell 16.1% from a year earlier, a smaller decline than the 34% fall recorded in May. That may show that the trade agreement hammered out by Washington and Beijing in Geneva, and London, this year has helped smooth trade flows.

There aren't signs – yet – of China's export juggernaut hitting a wall. Just-released June data show the big fall in US exports easing in June, allowing overall exports to continue to creep up.

If you are interested in the details of all the data just released, as well as lots… pic.twitter.com/6ysKSUetrf

Bitcoin at record high over $120,000

Bitcoin has surged to a new record high this morning, clearing the $120,000 point for the first time.

The world’s largest crypto currency is now trading at $122,571, amid interest from institutional investors and the Trump White House’s pro-crypto atmosphere. It has now gained 30% so far this year (and roughly 1,200% over the last five years).

Tony Sycamore, market analyst at IG, reports that money has been pouring into exchange traded funds which give exposure to Bitcoin, explaining:

Its gains have been driven by strong inflows into ETFs, including BlackRock’s Bitcoin ETF IBIT, which, after receiving $1.7bn in inflows last week, now manages $84bn in FUM (funds under management).

Ipek Ozkardeskaya, senior analyst at Swissquote Bank, suggests that bitcoin is “now back in overbought territory”, which could mean it slips back to the $105K–$110K range, adding:

Still, the rally is underpinned by a crypto-friendly US policy shift and growing emerging market adoption — both remain intact.

Update: that policy stance could turn even more friendly soon. It’s ‘crypto week’ in Congress, where US lawmakers will be considering a number of bills aimed at creating clearer regulatory frameworks for digital assets.

European stock markets are on track to open lower, following Donald Trump’s threatened 30% tariff on EU imports.

The EUROSTOXX 50 index of large European companies is down 0.72% in futures trading, while DAX futures (the German stock market) are down 0.84%, Reuters reports.

The euro is also weakening this morning, after Donald Trump announced that goods imported from the European Union will face a 30% US tariff rate from 1 August.

Trump’s latest trade war bombshell has disappointed the EU, as the two sides had been negotiating for weeks. Europe had hoped Trump would agree to a bare bones deal similar to the UK’s pact, that would have lowered tariffs on car exports and steel.

But instead, the US president has decided to impose higher costs for US importers who buy goods from the EU.

In response, the EU has decided to delay, again, its own retaliatory tariffs on US exports,

European Commission president Ursula von der Leyen said yesterday:

“The United States has sent us a letter with measures that would come into effect unless there is a negotiated solution, so we will therefore also extend the suspension of our countermeasures until early August.

“At the same time, we will continue to prepare for the countermeasures so we’re fully prepared.”

Given Trump’s track record, the planned August tariff increases aren’t guaranteed…

That may be why the market reaction is modest, so far, with the euro down 0.17% at $1.1669.

Introduction: Bank of England could cut rates faster if jobs market slows, governor says

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

The pound has dropped to a three-week low this morning, after the governor of the Bank of England said it could make larger cuts to interest rates if the jobs market slows quickly.

Andrew Bailey told The Times that “slack” was opening up in the UK economy, following the increase to employers’ national insurance contributions. That slack should create downward pressure on inflation.

Bailey insisted: “I really do believe the path is downward” for interest rates. Bank rate is currently 4.25%, following four quarter-point cuts in the last year, with the Bank next scheduled to set rates on 7 August,

Bailey added:

“If we saw the slack opening up much more quickly, that would lead us to a different conclusion.”

“I think the path [for interest rates] is down. I really do believe the path is downward but we continue to use the words ‘gradual and careful’ because … some people say to me, ‘Why are you cutting when inflation’s above target?’”

Governor Bailey also pointed to Rachel Reeves’s decision to hike taxes on employers, saying companies were:

“adjusting employment and hours and also having pay rises that are possibly less than they would have been if the NICs change hadn’t happened”.

Last week, the Guardian revealed that the Trust is to cut at least 550 jobs in efforts to save £26m after changes made in Reeves’s debut budget pushed up labour costs.

Hospitality firms have repeatedly warned that higher NICS will force them to cut jobs.

And indeed, new data this morning shows that the number of people hunting for jobs has surged at the fastest rate since the height of the Covid pandemic.

Following Bailey’s rate cut hint, the pound has dropped by 0.2% this morning to $1.3467.

That’s its lowest level since 23 June, three weeks ago, extending its recent losses.

7 hours ago

7 hours ago