HomeMarket NewsStocks NewsRaymond Q2 net profit plunges 76%; aerospace & defence and precision tech boost revenue

The Aerospace & Defence segment generated ₹81 crore in revenue, up 15% from ₹70 crore in Q2 FY25, while EBITDA grew 34% to ₹17 crore, with the EBITDA margin improving to 21% from 18% YoY. Shares of Raymond Ltd ended at ₹589.95, up by ₹13.90 or 2.41% on the BSE.

Diversified group Raymond Ltd on Monday (October 27) reported a net profit of ₹14 crore for the second quarter, down 76% from ₹59 crore in the same period last year. Revenue for the quarter rose 11.4% to ₹527.7 crore from ₹473.5 crore year-on-year.

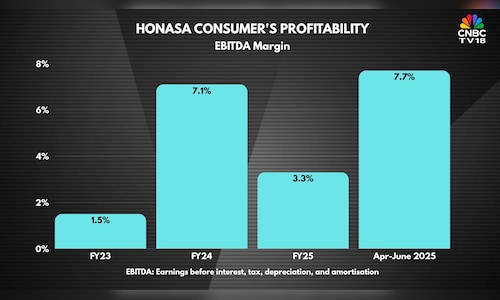

EBITDA increased 12.6% to ₹43.3 crore, up from ₹38.5 crore a year ago, while the EBITDA margin remained largely stable at 8.2% compared to 8.1% in Q2 last year.

Raymond reported a total income of ₹564 crore for Q2 FY26, reflecting a 10% increase compared to the same quarter of the previous financial year. The growth was primarily driven by the Aerospace & Defence and Precision Technology & Auto Components segments, reflecting a positive shift in the Indian supply chain.

Also Read: Raymond Lifestyle cuts Q1 loss; branded textiles, apparel drive revenue growth

Indian suppliers are moving up the value chain from simple assemblies to highly complex precision-machined components and subsystems, resulting in higher order intake for both Tier-1 and Tier-2 vendors for exports. EBITDA margin compression was largely driven by a decline in other income, the company said.

The Aerospace & Defence segment generated ₹81 crore in revenue, up 15% from ₹70 crore in Q2 FY25, while EBITDA grew 34% to ₹17 crore, with the EBITDA margin improving to 21% from 18% YoY. The growth was supported by a production ramp-up at a leading aerospace OEM and contributions from newly developed and approved parts that entered production this year. Higher sales volumes also helped boost EBITDA margins.

The Precision Technology & Auto Components segment recorded revenue of ₹409 crore, a 9.9% increase from ₹373 crore in Q2 FY25. EBITDA rose 57.3% to ₹57 crore, with the EBITDA margin improving to 13.9% from 9.7% YoY.

Also Read: IT officials conduct survey at Raymond Lifestyle, company responds

Strong domestic demand for Auto Components and Tools & Hardware components, coupled with increased demand for hybrid products in European markets, contributed to the performance. The EBITDA margin improvement was supported by higher sales volumes, a favourable product mix, and a one-time gain of approximately ₹13 crore.

Raymond continues to pursue expansion into new international geographies and industrial sectors, benefiting from the China-plus-one strategy, integration synergies, and operational efficiencies across segments. The company remains net-debt free with a net cash surplus of ₹27 crore.

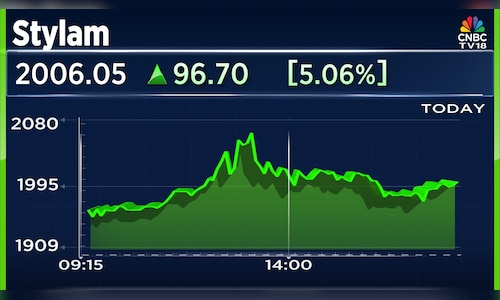

The results came after the close of the market hours. Shares of Raymond Ltd ended at ₹589.95, up by ₹13.90 or 2.41% on the BSE.

Also Read: Raymond Lifestyle shares tank 7% after Q4 net loss due to lower revenue

2 hours ago

2 hours ago