HomeMarket NewsOla Electric shares snap three-day rally, slide 8% from day's high

Around 19.35 crore shares had changed hands by 12:15 pm, higher than the 20-day average of 7.34 crore shares traded at that time of the day.

By Meghna Sen January 6, 2026, 12:30:41 PM IST (Published)

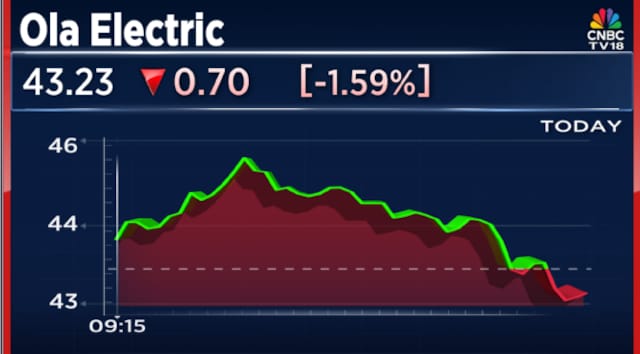

Shares of Ola Electric Mobility Ltd. declined as much as 8% from the day's highs on Tuesday, January 6, snapping a three-session winning streak.

The stock had rallied 22% over the previous three sessions. Trading volumes on Tuesday were about 50% of the combined turnover seen on Friday and Monday.

Around 19.35 crore shares had changed hands by 12:15 pm, higher than the 20-day average of 7.34 crore shares traded at that time of the day.

Despite the recent rally, the stock remains sharply lower from its highs. With Tuesday's decline, Ola Electric is down nearly 73% from its post listing high of ₹157 and about 44% below its IPO price of ₹76 per share.

According to VAHAN data, Ola Electric registered 9,020 vehicle registrations in December. Its market share rose to 9.3% during the month from 7.2% in November 2025, supported by Hyperservice, the company's focused service transformation initiative.

The company also said its market share in the second half of December climbed further to nearly 12%, indicating improving demand momentum.

Following the intraday decline, Ola Electric's market capitalisation slipped below ₹19,000 crore.

At the end of the second quarter, Ola Electric had cut its revenue and margin guidance for the full year.

The company now expects revenue in the range of ₹3,000 crore to ₹3,200 crore, sharply lower than the earlier projection of ₹4,200 crore to ₹4,700 crore. Auto business margins are now guided at around 5%, compared with the earlier target of above 5%.

Eight analysts currently track Ola Electric. Of these, three have a 'Buy' rating, one recommends 'Hold', while four have a 'Sell' call on the stock. Emkay has the highest price target on the Street at ₹65 per share, while Kotak Securities has the lowest target at ₹25.

1 day ago

1 day ago