HomeMarket NewsNeeraj Seth sees further Fed easing, bullish on gold, optimistic on Indian IPO market

Neeraj Seth, Founder and CIO of 3R Investment Management, said that if the Federal Reserve pauses rate cuts and the dollar continues to strengthen, gold prices could move lower against the dollar.

By Alpha Desk October 31, 2025, 10:49:03 AM IST (Published)

Neeraj Seth, Founder and Chief Investment Officer at 3R Investment Management, believes the US Federal Reserve has further room to cut interest rates and maintains a structurally positive view on gold, while also highlighting the strength of India's primary market. In a conversation with CNBC-TV18, Seth suggested that we have likely seen the peak of US tariff escalations, with the direction of policy now clearly softening.

Regarding the Fed's monetary policy, Seth stated that the recent 25 basis points rate cut was in line with his expectations. He anticipates that the central bank's future actions will remain data dependent. 'I still think the Fed has room to cut another 50 to 75 basis points before they pause. So, December is still very much in play,' he said, indicating a clear path for further monetary easing, contingent on incoming economic data.

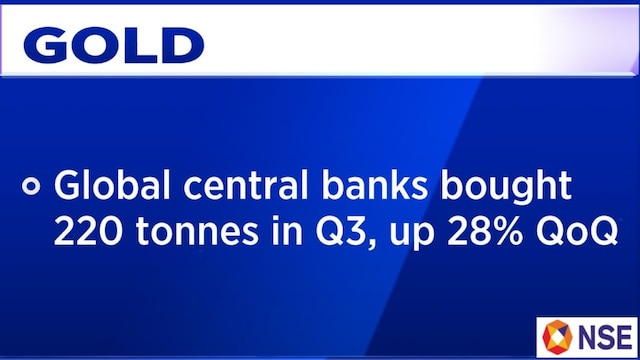

This dovish outlook on US rates is linked to his bullish stance on gold. Seth reiterated his medium-term positive view on the yellow metal, which he noted had recently done a 'round trip' after crossing the $4,000 per ounce mark. He explained the structural case for the precious metal, stating, 'It is taking the place of an alternative currency for central banks and savers.'

He cautioned, however, that this view depends on the continuity of current global monetary policy. 'If the Fed doesn't cut rates and the dollar keeps strengthening, then the dollar-gold obviously that cross can see gold coming lower,' he added.

Also Read:

India sees record festive gold demand despite high prices: World Gold Council’s Sachin Jain

Shifting his focus to India, Seth commented on the vibrant initial public offering (IPO) market. While his firm is less directly involved in IPOs, he sees the flurry of activity as a strong indicator of underlying market health. 'India is actually going through the phase of a lot of the financialisation of the system and in fact, probably the only country I can see where the IPO reflects the investor confidence in the market,' he observed.

Seth stated that this new equity issuance from IPOs is another important factor that will continue to bring foreign institutional investors (FIIs) back into focus as they look for opportunities in the Indian market.

Also Read: Joyalukkas posts record Diwali sales, bets big on studded jewellery

For the entire interview, watch the accompanying video

(Edited by : Unnikrishnan)

7 hours ago

7 hours ago