Out of 40 mutual funds invested in HDFC Bank, 34 stepped up their holdings in February, while 5 chose to dilute part of their stakes.

Mutual funds acquired another Rs 8,400 crore worth of HDFC Bank Ltd shares in February following a substantial purchase of Rs 13,500 crore in January.

MFs bought around 6.01 crore shares in February followed by 8.83 crore shares bought in January. As of February 2024, mutual funds held around 142.27 crore shares of the bank from 136.26 crore in January. However, the value of these shares decreased from Rs 2.15 lakh crore to Rs 2.02 lakh crore during this period, according to ACE Equities data.

Of the 40 mutual funds invested in HDFC Bank, 34 stepped up their holdings in February, while 5 chose to dilute part of their stakes. Quant Mutual Fund, which was holding around 1.95 lakh shares, has completely exited. ICICI Prudential Mutual Fund led the buyers with the highest purchase of Rs 2,983 crore followed by Nippon India and HDFC MF at Rs 1.,043 crore and Rs 917 crore.

SBI Mutual Fund is the largest stakeholder in HDFC Bank holding Rs 51,248 crore of shares as of February 2014. HDFC Mutual Fund and ICICI Prudential Mutual Fund hold the second and third positions with Rs 23,630 crore and Rs 22,128 crore of shares. Other major stakeholders include UTI Mutual Fund, Nippon India Mutual Fund, Kotak Mahindra Mutual Fund and Mirae Asset Mutual Fund.

In January, the stock faced a downturn due to disappointing earnings. Investors expressed concerns about underperformance in net interest margins (NIM), sluggish deposit growth, and slower-than-expected retail growth following the lender's Q3 results.

Following a recent decline, multiple brokerages raised their target prices for HDFC Bank. Citi issued a 'buy' rating with a target of Rs 2,050 per share, indicating a 44 percent upside. Analysts at Citi are optimistic about the bank's robust and sustainable franchise, anticipating profitable growth. Morgan Stanley also labelled HDFC as 'overweight' with a target price of Rs 2,110 per share, responding to the management's announcement of stable double-digit year-on-year growth in the home loan business post-merger until December 31, 2023.

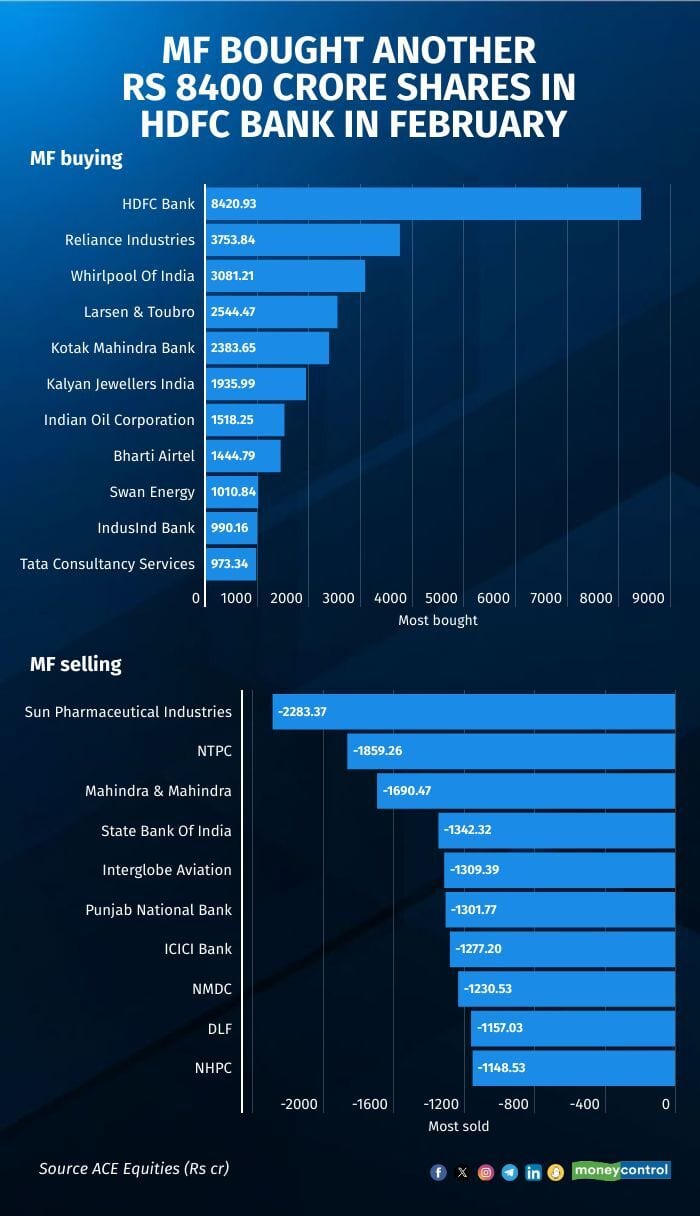

Other blue chip stocks such as Reliance Industries Ltd, Larsen & Toubro, Kotak Mahindra Bank, Indian Oil Corporation, Bharti Airtel Ltd, IndusInd Bank, and Tata Consultancy Services Ltd witnessed significant buying, with amounts ranging from Rs 973 crore to Rs 3753 crore.

In the mid-cap segment, Whirlpool of India and Kalyan Jewellers India experienced buying of around Rs 3754 crore and Rs 1936 crore, respectively. On the selling side, Sun Pharmaceuticals, NTPC, and Mahindra & Mahindra were notable, with selling amounts of Rs 2,283 crore, Rs 1,859 crore, and Rs 12,690 crore. SBI and Interglobe Aviation also saw selling worth Rs 1,342 crore and Rs 1,309 crore, respectively.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

1 month ago

1 month ago