HomeMarket NewsIndian Oil Q2 Results: Refining margins to contribute to better operating performance

Indian Oil's operating profit margins may expand by 90 basis points to 7.4% to 6.5% in June, while profitability may increase by nearly 12% quarter-on-quarter to ₹6,353 crore.

Shares of Indian Oil Corporation Ltd. (IOC) are trading with gains of nearly 3% on Monday, October 27, ahead of its second quarter results that will be reported soon.

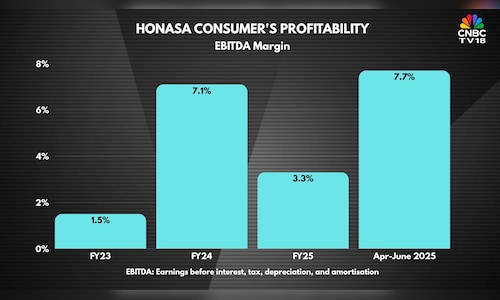

A CNBC-TV18 poll is expecting the company's revenue to decline by 8% on a sequential basis to ₹1.77 lakh crore, while the Earnings Before Interest, Tax, Depreciation and Amortisation (EBITDA) for India's largest refiner may improve by 4% sequentially to ₹13,124 crore.

Operating profit margins may expand by 90 basis points to 7.4% to 6.5% in June, while profitability may increase by nearly 12% quarter-on-quarter to ₹6,353 crore.

Indian Oil's EBITDA is likely to improve sequentially as well as from the same quarter last year due to better refining margins, while under-recoveries in LPG sales are likely to be lower due to a rise in cylinder prices and lower propane prices.

Reported Gross Refining Margins are likely to be at $6.5 per barrel during the quarter. GRMs are the difference between the value of the petroleum products and the cost of crude oil. It is calculated as the total value of products minus the cost of crude oil.

Shares of Indian Oil Corporation are currently trading 2.6% higher at ₹154.33. The stock has risen 12.6% so far in 2025.

5 hours ago

5 hours ago