The upper limit available to asset management companies to invest in overseas securities is $7 billion.

Indian investors who have diversified their portfolios by investing in international mutual funds have seen handsome returns over the last year.

At present, there are 70 Indian schemes, with assets under management (AUM) of around Rs 70,000 crore, that focus on themes such as artificial intelligence, emerging technologies, semiconductors, and electric vehicles in overseas markets.

The growth in AUM has come despite restrictions on investments in overseas markets by domestic mutual funds.

The Securities and Exchange Board of India (SEBI) last week asked mutual fund houses to stop accepting inflows into funds that invest in overseas Exchange-Traded Funds (ETFs), limiting options for investors looking to diversify overseas.

Also read | Mutual funds call for easing RBI's limit on overseas investments amid growing opportunities

The upper limit available to asset management companies (AMCs) to invest in overseas securities is $7 billion. Since this limit was reached in January 2022, SEBI had asked fund houses to stop investing overseas. The limit to invest in overseas ETFs is $1 billion, which is also about to be breached.

Tech rebound

mutual fund subscriptions declined over the last two and a half years till the last quarter of 2023, owing to lacklustre returns from global equity markets, restrictions on overseas investments by mutual funds, and alterations in taxation policies.

However, returns over the past three months have been good because of a rebound in global technology stocks.Also Listen: Simply Save podcast | Do international mutual funds still make sense for Indian investors?

For example, on a three-month basis, the top two performing schemes are Nippon India Taiwan Equity Fund (18 percent) and Bandhan US Equity FoF (17.46 percent). Even on a one-year basis, these two funds have delivered 41.67 percent and 50 percent, respectively.

Top performers

funds first started to gain attention three-four years back as the Nasdaq 100, the technology-led index in the US, did exceedingly well. The term FAANG stocks (Facebook, now Meta, Apple, Amazon, Netflix and Google, now Alphabet) gained prominence.

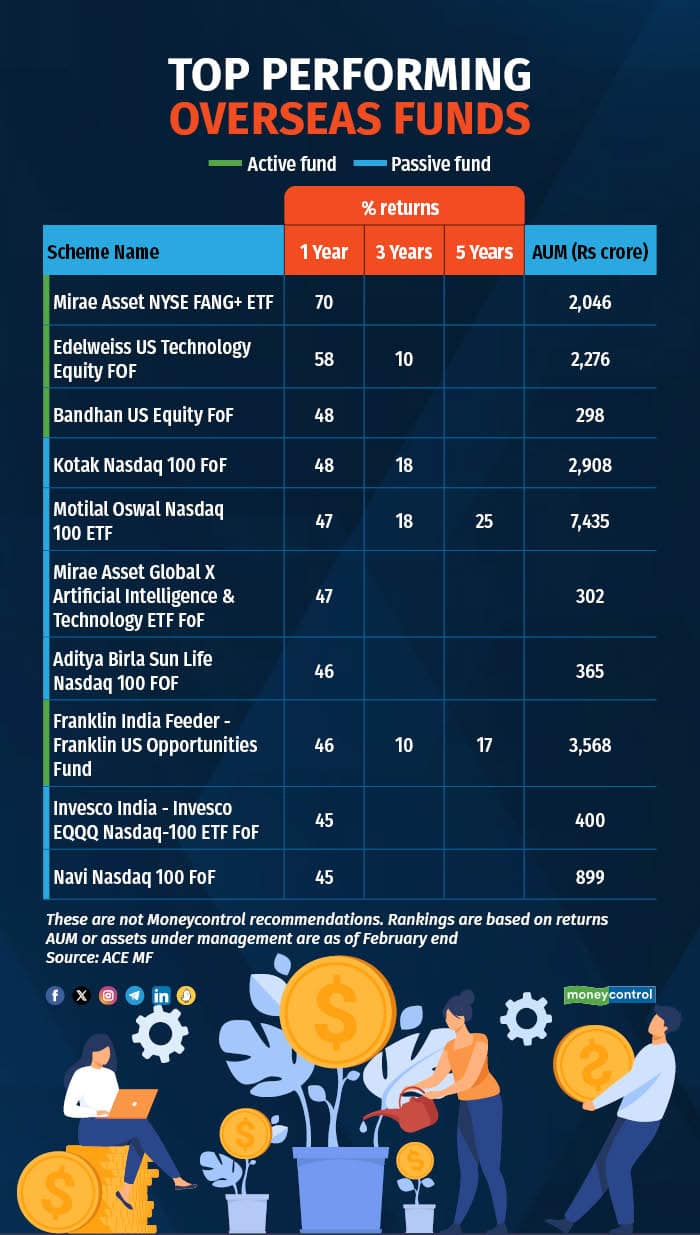

One-year data shows that the majority of funds in the top-10 list invest in US markets.

The top performing fund is Mirae Asset NYSE FANG+ETF, which has delivered 70 percent returns on a one-year basis, as per data available with ACE MF. Mirae Asset NYSE FANG+ is highly concentrated with just 10 US-listed technology stocks in the portfolio.

The Edelweiss US Technology Equity FoF delivered 58 percent returns during this period, while Bandhan US Equity FoF and Kotak NASDAQ 100 FoF gained 48 percent each.

Biggest losers

On the other side, China-focussed funds have been the worst performers.

Since the beginning of 2022, various challenges, including the property market downturn, sporadic Covid outbreaks, policy constraints, and the slowdown in export growth have significantly impacted the Chinese economy and consequently, the markets.

In early 2023, there was widespread anticipation that the Chinese economy, and global investments in China, would experience an upturn following the country's decision to abandon its zero-Covid policy and initiate an open-door approach.

However, Chinese markets are still in the doldrums.

Data shows that the Edelweiss Greater China Equity Off-Shore Fund has been the worst-performing overseas fund with returns of -11.57 percent on a one-year basis, followed by Axis Greater China Equity FoF (-10.04 percent), and Mirae Asset Hang Seng TECH ETF FoF (-9.36 percent).

Investor strategy

If an investor is looking to invest overseas, most global funds, apart from ETFs, are accepting fresh investments at this point (as they have some leeway due to redemptions, etc). However, this can change at any time depending on the headroom available to the fund houses.

Also Listen: Simply Save podcast | Will mutual fund stress test results help investors?

Further, many domestic funds have a mandate to invest in global securities. These funds can provide some exposure to global markets while staying within the regulatory limits.

“The FOF (fund of funds) option for overseas investing is expected to close soon. Also, the Reserve Bank of India might not look to raise the ceiling for overseas investing by mutual funds as its focus is to stabilise money supply. There is another option for overseas investing, which is domestic funds with an overseas mandate. However, if you are looking to invest overseas, the best strategy would be to wait and watch, because one shouldn’t rush into any investment that doesn’t align with your portfolio allocation,” said Rushabh Desai, Founder of Rupee With Rushabh Investment Services.

1 month ago

1 month ago