Last Updated:May 15, 2025, 00:12 IST

Despite multiple Chinese weapons underperforming during Operation Sindoor, China launched an aggressive misinformation campaign.

Pakistan used Chinese weapon systems, including jets, during conflict with India | Image/Reuters

China is leveraging the recent India-Pakistan conflict to accelerate its ambitions of becoming a top-tier global arms supplier, challenging the dominance of the United States and Russia in the defence export market.

Top intelligence sources told CNN-News18 that Beijing turned the conflict into a live demonstration of its weapons, providing around 81 per cent of Pakistan’s defence equipment during the operation.

This included high-profile deployments of J-10C fighter jets, PL-15 long-range air-to-air missiles, and Wing Loong drones—making Pakistan a de facto display window for Chinese arms.

Marketing War?

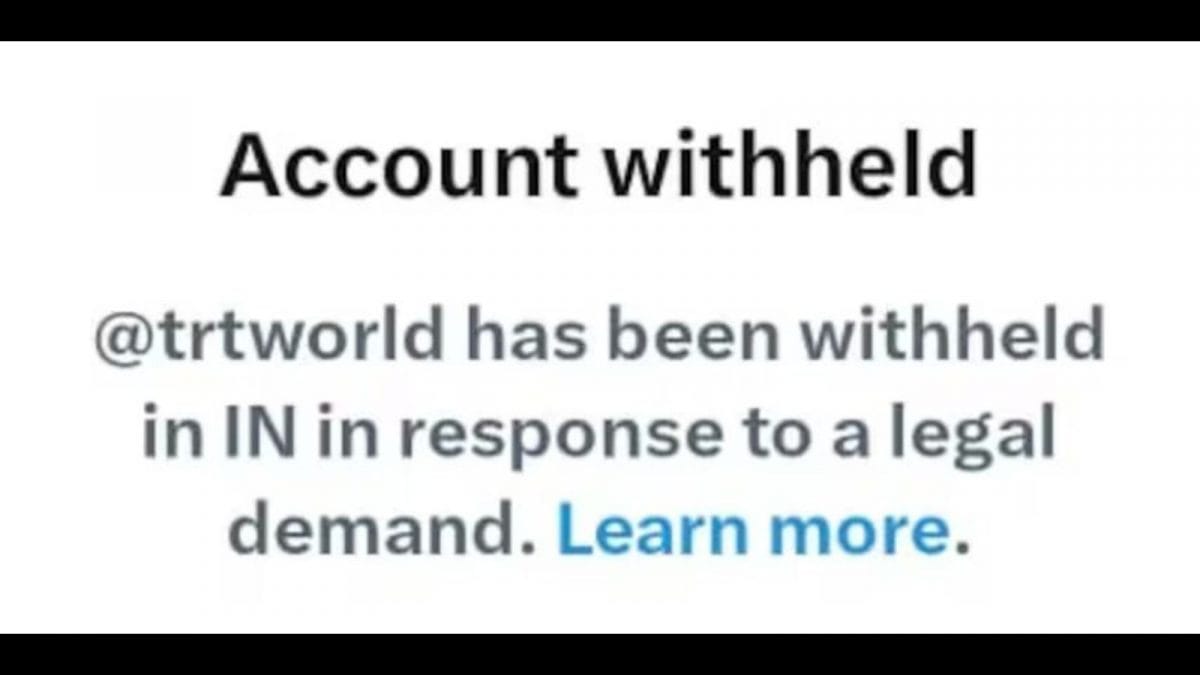

Despite multiple Chinese weapons systems underperforming during the conflict—particularly the PL-15 missiles, which were intercepted by India’s Indigenous Akashteer air defence system—China launched an aggressive misinformation campaign.

Chinese state media, especially Global Times, amplified Pakistan’s false claims of shooting down Indian Rafale jets using AI-generated videos and recycled footage, crafting a narrative of parity with Western technology.

The coordinated disinformation effort, supported by Pakistani media, aimed to project Chinese weaponry as battle-tested, reinforcing Beijing’s strategic narrative and commercial aspirations.

Economic Motive

Chinese defence stocks surged in the immediate aftermath of the India-Pakistan conflict. AVIC Chengdu Aircraft, which manufactures the J-10C, saw a 36 per cent spike in share value within two days. Analysts say this reflects how Beijing turned a limited regional conflict into a marketing blitz for its arms industry.

The price advantage is another major selling point. China offers weapons at 30–50 per cent less than Western alternatives.

For instance:

JF-17 Thunder: $25 million per unit (vs. $115 million for India’s Rafale)J-10C Vigorous Dragon: $40–50 millionPL-15E missiles: $1–2 million each (vs. Meteor missiles at $2.5–3 million)These competitive prices attract interest from budget-conscious militaries, particularly in Africa and the Middle East. Algeria and Nigeria have reportedly shown renewed interest in acquiring JF-17 fighters and Wing Loong drones following the conflict.

Pakistan As A Showcase Client

Pakistan’s heavy reliance on Chinese arms—amounting to $20 billion in pre-war defence deals—has made it China’s most prominent client and a strategic partner in its global arms push.

The conflict further highlighted Beijing’s role as Pakistan’s sole major weapons supplier.

However, defence experts note that Operation Sindoor was also a “wake-up call" for China’s arms industry. Battlefield failures provided actionable insights for research and development, which Chinese manufacturers are expected to use to enhance future systems.

A New Kind Of Arms Dealer

China’s approach signals a shift in global arms trade norms. By blending real-world deployments with aggressive disinformation, Beijing is emerging as a “hybrid arms dealer"—one that markets not just weapons, but the illusion of technological dominance.

Operation Sindoor, while militarily mixed, was a strategic experiment for Beijing. And despite the setbacks, the operation may mark a turning point in China’s quest to secure a seat at the table of top global arms exporters.

Location :China

First Published:News world Despite Battlefield Setback, China Eyes 'Top Tier' Arms Exporter Status Post Op Sindoor | Exclusive

5 hours ago

5 hours ago