HomeMarket NewsAlfAccurate’s Rajesh Kothari sees consumption, capex and credit driving next growth phase

Rajesh Kothari, Managing Director of AlfAccurate Advisors highlights growth opportunities in new-age infrastructure, including HVDC power, data centres, and modern rail projects.

After a strong festive season and with markets hovering near all-time highs, optimism is returning to Dalal Street.

According to Rajesh Kothari, Managing Director of AlfAccurate Advisors, which manages assets worth nearly ₹3,406 crores, the next leg of the rally may just be beginning — driven by what he calls “double-engine growth” in consumption and capex.

Kothari believes India is entering a phase where both public and private investments will fire together. “From 2022 to 2024, consumption was under pressure while the government drove growth through heavy capex. Now, consumption is reviving, and capex continues. So all growth engines — credit, consumption, and capex — are turning on,” he said, adding that valuations across sectors remain comfortable.

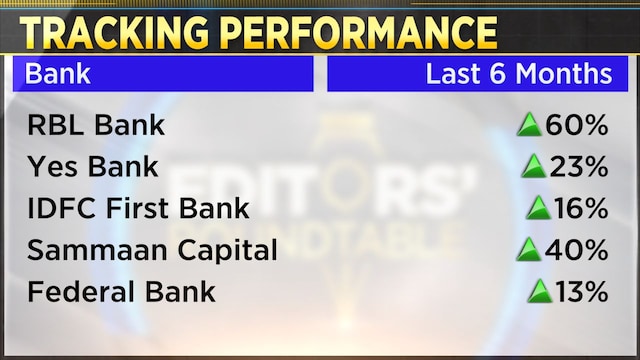

Banks to lead FY27 earnings growth

Banking, which forms nearly a third of the Nifty, is expected to be the biggest contributor to earnings growth in FY27. Kothari pointed out that large banks like HDFC Bank, ICICI Bank, and Axis Bank have delivered strong results, surprising on net interest margins (NIMs) and maintaining solid asset quality.

“Thanks to RBI’s liquidity support, any NIM pressure will likely be short-lived. By FY26–27, NII growth should return to double-digits,” he said.

On portfolio positioning, Kothari prefers a mix of large private banks and niche NBFCs. “We like housing finance companies, select corporate banks, and even some microfinance players where turnarounds are visible. In NBFCs, we own Bajaj Finance, Cholamandalam Finance, and Shriram Finance — each a market leader with strong RoEs and disciplined capital management.”

Capex Cycle: Power, Data Centres and Railways in Focus

Kothari sees no major portfolio change in his capex themes but expects the next wave of private investments to emerge from new-age infrastructure. “We continue to hold players in HVDC power equipment, pump manufacturers, and diesel generator (DG) sets. Data centres are becoming the biggest capex story — about 40% of a data centre’s cost goes into electrification, benefiting transformer makers such as Hitachi Energy,” he said.

He also sees opportunities in modern rail infrastructure such as Vande Bharat and Tejas trains, where large transformer and electrical equipment suppliers could be key beneficiaries.

Consumption Revival: Premiumisation and New Categories

On discretionary consumption, Kothari expects revival trends to sustain beyond the post-GST and festive surge. “Premiumisation will accelerate — whether it’s SUVs, premium two-wheelers, or airbag manufacturers in auto ancillaries,” he noted.

He added that the shift from unorganised to organised players continues across food, luggage, and consumer durables. “We are also seeing emerging segments like CCTV equipment — a category once dominated by imports — now offering listed, made-in-India opportunities.”

IPO Market: Selectivity is Key

While the IPO market remains busy, Kothari urges caution. “Only about 10% of IPOs are worth holding long term. We recently participated as anchor investors in a solar pump EPC company with strong RoCE and cash flows. The government’s KUSUM Yojana makes this a structurally attractive space,” he said.

For the entire discussion, watch the accompanying video

14 hours ago

14 hours ago