Ajay Goyal, Chairman of the Wheat Products Promotion Society, said India is on track for a potential record wheat harvest of 117 million tonnes, weather permitting, which would surpass all previous highs.

Ajay Goyal, Chairman of the Wheat Products Promotion Society, said India is heading into one of its biggest wheat surpluses ever, making a review of the export ban almost unavoidable next year. He stated that with government stocks likely to cross 50 million tonne by June 1, the policy direction must change simply because “the market doesn’t need the government wheat this year.” This surplus-driven policy pressure is the most consequential development because it impacts procurement, pricing, private trade behaviour and the broader supply-demand balance.

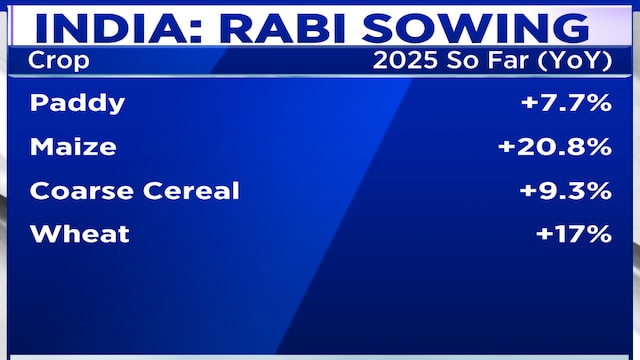

Goyal explained that rabi sowing has been 10–15 days early, setting the stage for acreage to rise 3–4% over last year. He added that India is on track for a potential record 117 million-tonne wheat crop, weather permitting, which would surpass all previous highs.

On procurement, he expects one of the strongest carryovers in years, with the government potentially holding 30 million tonne from new procurement and another 20 million tonne as carry-in, pushing stocks to multi-year highs. This, he said, reinforces the need for the Centre to “relook at the entire export ban.”

Goyal also pointed to policy inaction on wheat product exports—an area where the industry has been awaiting a Directorate General of Foreign Trade (DGFT) notification. With a glut building, he warned it would be “unfortunate if it doesn’t come now,” given that the next 3–4 months could see intense oversupply.

Also Read | India back in a sweet spot on wheat and rice stocks after years of volatility: Somnath Chatterjee

Demand, meanwhile, remains disappointingly weak. Despite winter, goods and services tax (GST) cuts and good weather, consumption across flour, biscuits, bread, noodles and baked products has been flat. He stated that overall wheat demand is “just static,” with private trade still holding 4–5 million tonne and likely to carry stocks into next year.

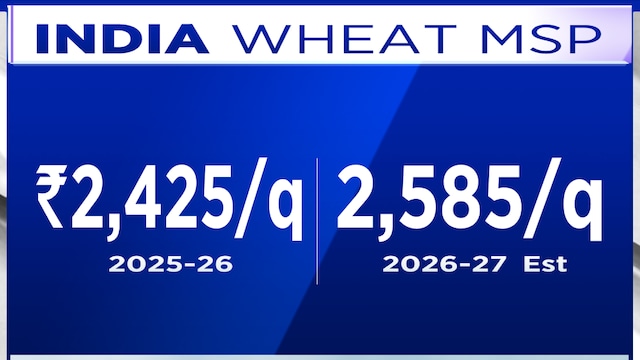

Prices too remain subdued, stuck at the same levels as the beginning of the season due to oversupply and lacklustre buying. Even Open Market Sale Scheme (OMSS) operations have seen low participation, with releases happening just once a fortnight and less than one-third of the wheat being lifted.

Also Read | India set for record wheat planting as soil moisture and prices rise

Goyal added that in its current state—surplus, weak demand and stagnant prices—the market is showing clear signs of disinterest, and the government will eventually be forced to revisit its export stance.

For the entire interview, watch the accompanying video

1 hour ago

1 hour ago